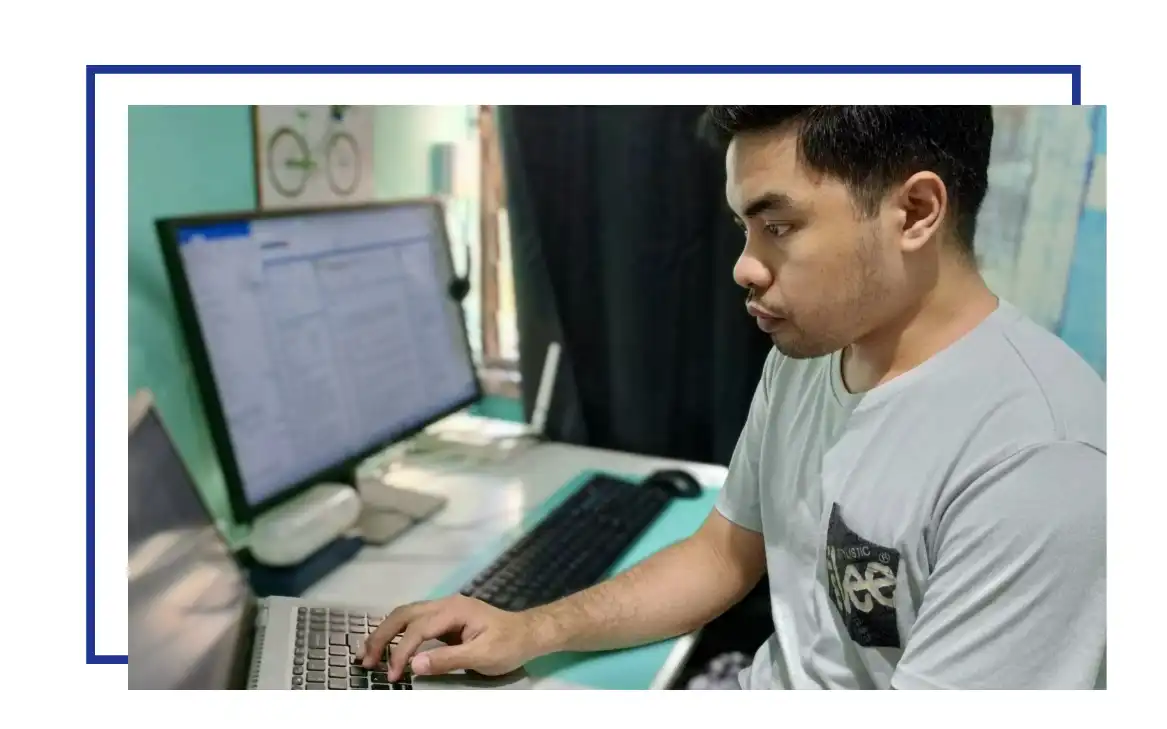

As a working student and the breadwinner of his family, Ken Mangunay is very particular with his finances and everyday routine. Since he’s able to work remotely and attend school online with Mapúa Malayan Digital College (MMDC), Ken has more flexibility when it comes to his schedule and can effectively manage tasks. “The ability to access coursework from anywhere and at any time allows me to integrate my learning seamlessly into my work schedule,” he shared. “This flexibility is a game-changer, enabling me to juggle professional responsibilities and academic commitments more efficiently.”

But more than just finding balance among the many things that he does, Ken makes sure every single day is purposeful. “Mondays are my academic [preparation] days. No waiting until the last minute — I like to stay ahead of my classes and requirements,” he shared. From Tuesday to Saturday, he works as a Senior Customer Advocate at Boldr and takes on the role of a mentor and resource for new team members. He also attends classes on Tuesdays and works on his homework and milestones on Wednesdays and Thursdays. Sundays are his rest days when he makes time to be with his loved ones. Having this set routine keeps his dreams of buying his family a house and owning his cafe alive.

How a working student and breadwinner manages his finances

Ken’s studies took the back seat in 2016 due to financial constraints and again in 2017 despite having a scholarship discount. When his parents separated, he stepped up as the head of the household and worked even harder to provide for his family. “As a breadwinner, intending to graduate with honors, working while studying became a necessity,” he shared. “I find myself in a situation where I don't have the luxury to solely focus on either work or academics; instead, I navigate the balance between the two to achieve my aspirations. Climbing the corporate ladder and increasing my income are paramount goals.”

Ken holds himself to the highest possible standard despite having so much on his plate, including how he budgets his finances. He sets aside more than half of his salary to support his family and the rest of his income covers study expenses, bills, and personal needs. He allocates P24,000 each month to pay for rent and groceries. He also covers the utility bills that amount to P3,000. He sets aside another P5,000 per month for his tuition fees per term, around P3,000 for his orthodontic treatment, and P2,300 for his gym membership. He also sets aside money for his emergency fund and other personal expenses.

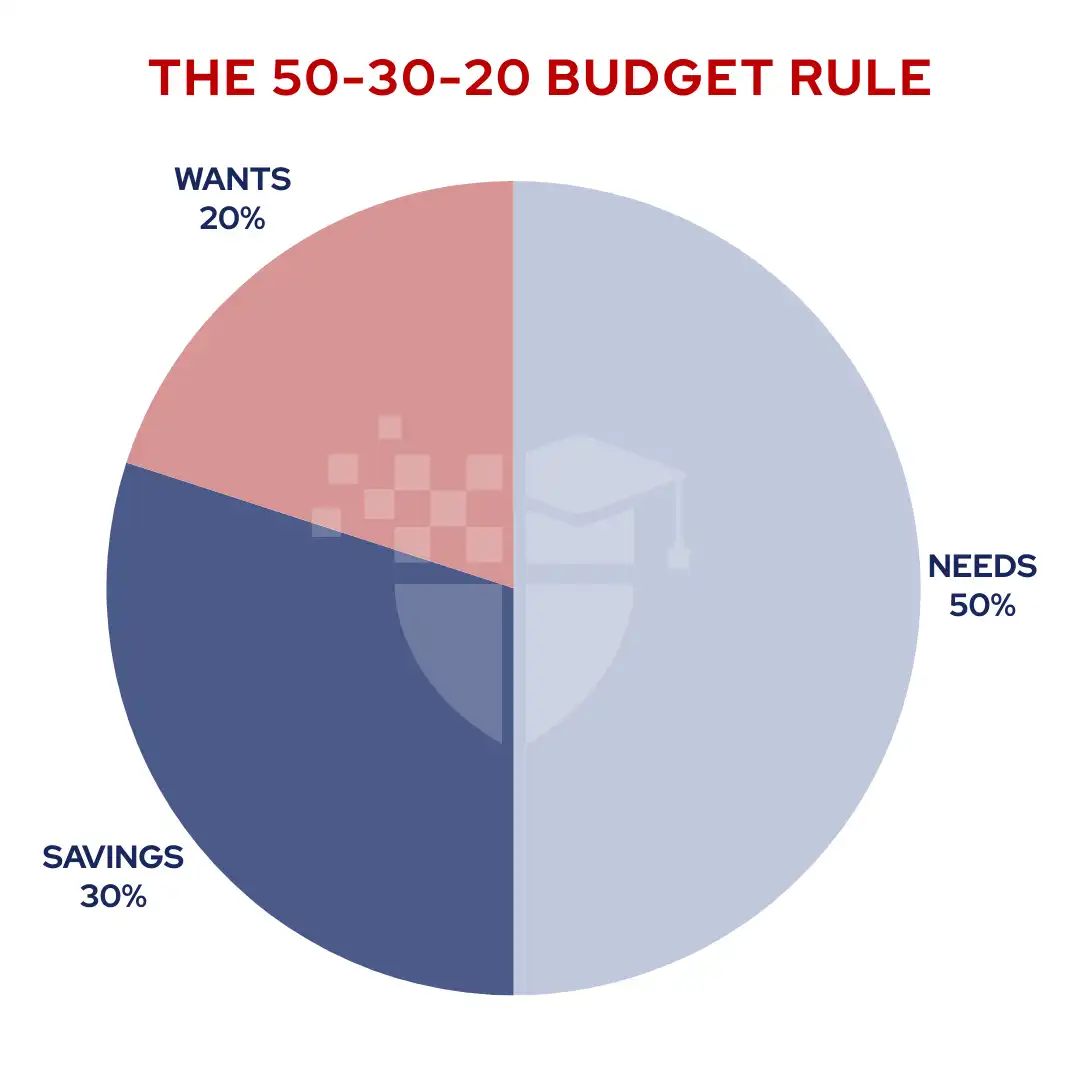

The remainder of this income serves as his emergency fund and covers personal expenses following the 50-30-20 rule where 50% of one’s income goes towards needs, 30% toward wants, and 20% towards savings.

Ken also makes it a point to allocate a certain percentage of his income to his travel fund so he can create memorable experiences with his loved ones. This practice of saving with intention enables him to balance his and his family’s immediate needs and long-term aspirations, which makes him spend and save wisely. “Growing up with less has taught me to be smart with money and to find happiness in simple things,” he said. “Sacrificing my [wants] doesn't feel hard because making my family happy, especially my mom, is my biggest joy.”

Here are some tips from Ken on how to manage finances:

- Prioritize the must-haves first like groceries and bills.

- Be real with yourself when creating a budget and tracking every expense – it's an eye-opener. The sacrifices you make now will make a huge difference in the future and will have an impact on achieving your goals.

- Tuck away a bit for emergencies; it's your financial safety net.

- Plan your meals to save money and stay healthy.

- Keep an eye out for discounts; being a student often comes with perks.

- Set achievable financial goals – they keep you focused.

- Expenses that help you succeed in work and education, as well as self-care, are important and are okay to be prioritized.

- Negotiate bills if you can; every bit saved counts.

- Don't shy away from budgeting apps; they can be real lifesavers.

Though one’s expenses, income, and priorities differ, one should invest in opportunities that will help build the foundation for a more abundant future. Try this template to help you manage your own expenses and budget your income wisely based on your lifestyle and spending habits.

Small steps add up and lead to a much bigger goal. What steps do you take to manage your finances?

Start your MMDC journey at any term within the school year! Enroll for Term 1 starting in May (Classes from August to November), Term 2 in December (Classes from December to March), or Term 3 in April (Classes from April to July). For more information on MMDC’s programs, click here.